how much federal tax is taken out of my paycheck in illinois

How much is 75k after taxes in Illinois. The Illinois salary calculator will show you how much income tax is taken out of.

Illinois Payroll Services And Regulations Gusto Resources

According to the Illinois Department of Revenue all incomes are created equal.

. See how your refund take-home pay or tax due are affected by withholding amount. 10 12 22 24 32 35 and 37. Personal income tax in Illinois is a flat 495 for 20221.

The Illinois state income tax is a flat rate for all residents. These are the rates for. Do I have to file as a nonresident of Illinois.

For Indiana the credit for taxes paid to other states is an offset credit. Use this tool to. If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to.

Estimate your federal income tax withholding. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use to figure federal income tax withholding.

That means that your net pay will be 43041 per year or 3587 per month. There are seven federal tax brackets for the 2021 tax year. The Federal Insurance Contributions Act or FICA tax is made up of the Medicare tax and the Social Security taxIn 2022 the Social Security tax requires employers and employees to each.

How do I figure out the percentage of taxes. Unlike Social Security all earnings are subject to Medicare taxes. How much is 75k after taxes in.

Just enter the wages tax withholdings and. This marginal tax rate means that your immediate additional income will be taxed at this rate. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding.

Employees who file for. How Much Federal Tax Is Taken Out Of My Paycheck In Illinois. How much taxes is taken out of a paycheck in Illinois.

What percentage is taken out of. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Employers are responsible for deducting a flat income tax rate of 495 for all employees.

How much is 90k after taxes in Illinois. Employers in Illinois must deduct 145 percent from each employees paycheck. Yes Illinois residents pay state income tax.

Jun 07 2019 My job takes out Indiana state taxes not Illinois taxes. Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Illinois has recent rate changes Sun Jul 01 2018.

Select the Illinois city from the list of popular cities below to see its current sales tax rate. Your average tax rate is 217 and your marginal tax rate is 360. Illinois tax year starts from july 01 the year before to june 30 the current year.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Your bracket depends on your taxable income and filing status.

Time To Review W 4 Forms News Illinois State

Illinois Payroll Tax Guide 2022 Cavu Hcm

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How To Read Your Paycheck Stub Clearpoint

Illinois Payroll Tax Guide 2022 Cavu Hcm

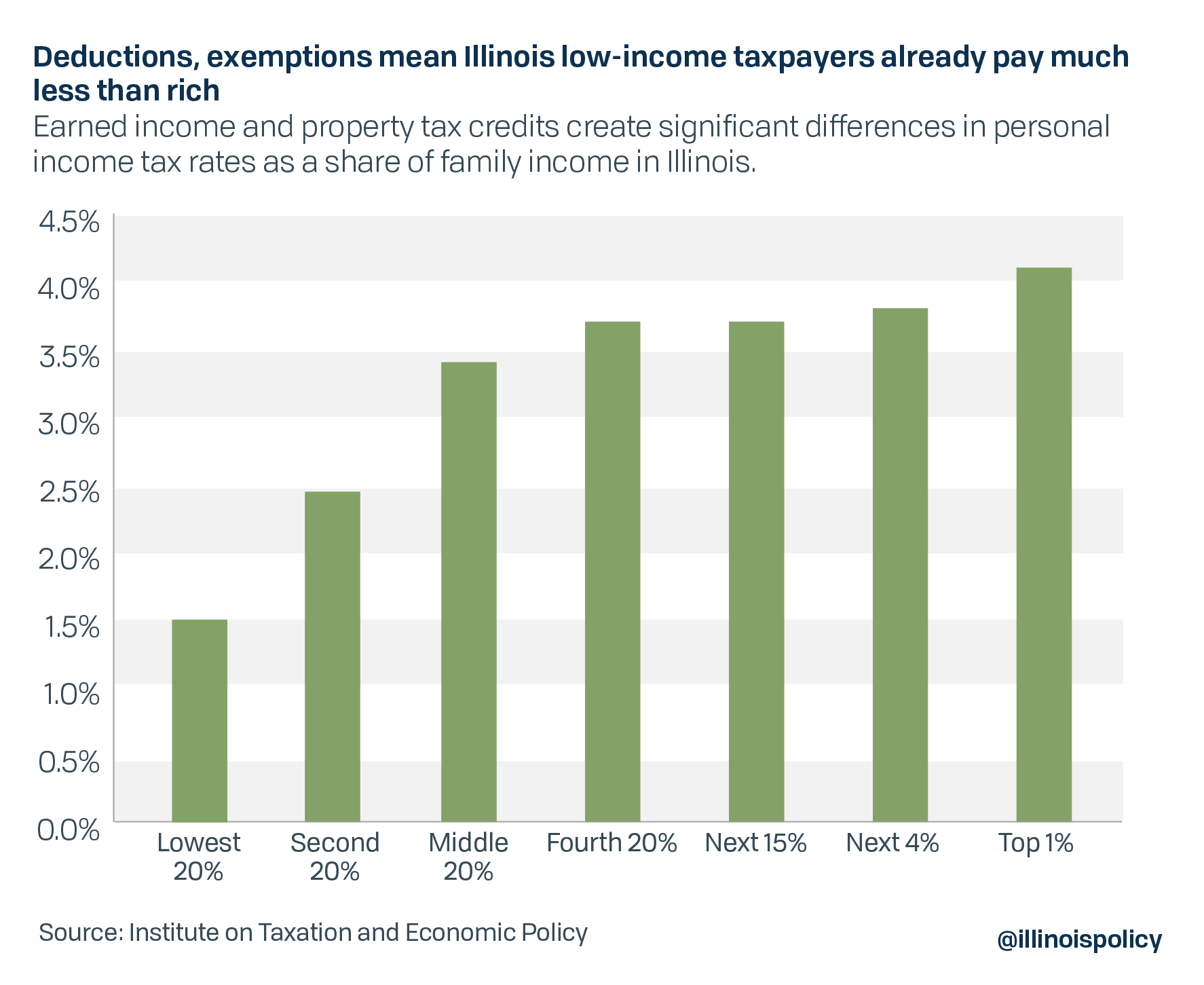

Exemptions And Deductions Give Low Income Illinoisans Less Than Half Tax Rate Of Rich

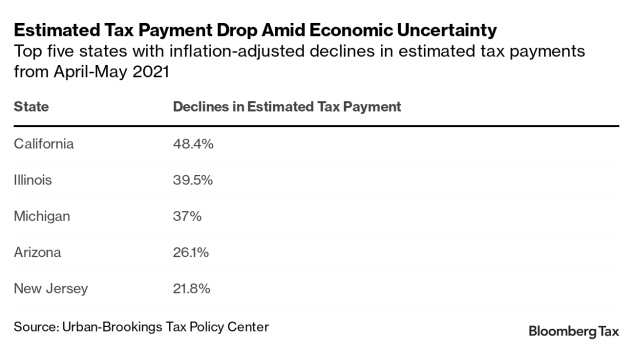

State Tax Withholding Weakens As Inflation Hits Us Wages 1

Illinois Payroll Tax Guide 2022 Cavu Hcm

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

Tax Withholding For Pensions And Social Security Sensible Money

Illinois Income Tax Calculator Smartasset

Government Will Take Almost Half Your Paycheck In 2013

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

How Much In Federal Taxes Is Taken Out Of Paychecks

Illinois Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Illinois Gov Jb Pritzker Releases State Federal Tax Returns 1 Month After Gop Rival

Free Online Paycheck Calculator Calculate Take Home Pay 2022